“Second Charge Lenders Still Have a Good Appetite” – David Beard of Lending Expert

A founder of one of the UK’s leading price comparison …

After property or land is purchased in the UK or Scotland there is a one-off lump sum compulsory tax that is know as Stamp Duty, or Stamp Duty Land Tax (SDLT).

It must be paid within 30 days of completing the purchase of a property otherwise fines may be administered. It is very important to take in to account the cost of stamp duty when you are a first time buyer, purchasing property to let-out or if you are thinking about refurbishing a property to sell.

The general rule is that the more expensive the property, the more stamp duty you will pay, both the gross amount, and total percent of purchase price.

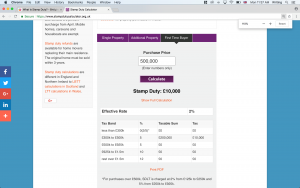

The total amount you will pay in Stamp Duty is directly related to the value of the property that you are purchasing. The higher the value of the property, the more you will pay. In November 2017, the Chancellor of the Exchequer changed the rates that are payable on properties. The current tiered structure of payments is progressive and means that you pay a portion of tax on each level of tax.

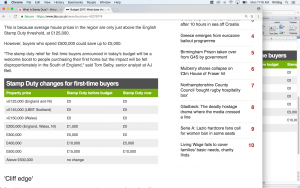

Stamp duty was abolished by Philip Hammond for first-time buyers spending up to £300,000 as a way of helping them save and get up the ladder. The new rules also mean that if you’re purchasing a home up to £500,000 you could save up to £5,000.

So in total this means you will pay £10,000 (£0 + £10,000)

The new calculations heavily favour those buying their new home, especially if it costs under £300,00 and also if it is up to £500,000.

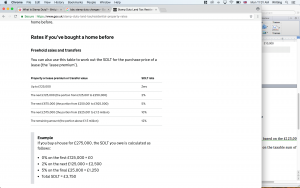

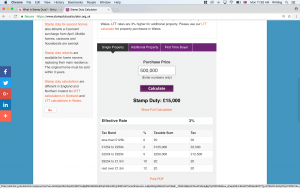

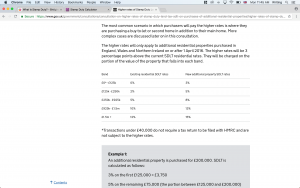

Anyone who is purchasing a property in addition to their main residence will now be subject to a significantly higher SDLT (Stamp Duty Land Tax) as long as the value of the main estate is higher than £40,000. Depending on the purchase price the stamp duty due can be up to double the cost of stamp duty for the primary property.

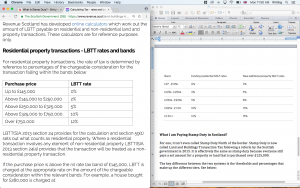

In Scotland, stamp duty is now called Land and Buildings Transaction Tax following a reform by the Scottish government in 2015. It is effectively the same as stamp duty because buyers still pay a set amount for a property or land that is purchased over £125,000.

The key difference between the two systems is the thresholds and percentages that make up the different tiers. See below:

Stamp Duty payments are usually handled by the solicitor that is arranging your property purchase and mortgage. They are usually keen to get this paid which why some solicitors will request the stamp duty money upfront and some will pay it afterwards – so it is good to find out when your solicitor wants the stamp duty to be paid. Regardless of your solicitors, it is essential to pay it within a 30-day window to avoid paying fines.

| Length of delay | Amount of penalty |

| Documents late by up to 12 months | 10% of the duty, capped at £300 |

| Documents late by 12 to 24 months | 20% of the duty |

| Documents late by more than 24 months | 30% of the duty |

Paying through your lawyer makes the process easier but if you want to pay it yourself you will need to find your unique 11-digit reference number (UTRN) which you can find either on your stamp duty return or online.

You are then able to pay by phone or online to the HMRC’s bank account. Payments can take up to three days so being proactive and getting the payment in early is key to avoiding any fines. There are further options to pay by post, cheque, or credit card (a fee is payable for CC). To verify this transaction, you may be required to present a valid pay-slip when paying by cheque or post.

A founder of one of the UK’s leading price comparison …

What Are Personal Loans Used for? Consolidating existing debt Make …

How Do Bad Credit Loans Work? Loans for bad credit …